The current state of our economy has everyone feeling the effects of rising interest rates and inflation, whether buying a new car or making a trip to the grocery store. But what do these key economic markers mean to the value of businesses and what actions do business owners need to take to react accordingly?

Following the recovery from The Great Recession, the past decade has been characterized by historically low inflation as measured by the Consumer Price Index (“CPI”). However, since the start of 2021 the CPI has grown almost 900%, a pace not seen in 40 years. This has prompted the Federal Reserve (the “Fed”) to raise the federal funds rate in an attempt influence interest, cool consumer demand, and ultimately slow inflation.

So, how did we get here? What created the current inflation surge we are experiencing? The onset of the pandemic created an abrupt drop in economic activity. In response, Congress and the Fed took actions to stimulate the economy by putting more money in the hands of consumers and businesses. The stimulus was intended to offset the drop in economic activity, and in many ways it appears to have succeeded. Stuck at home, consumers responded by spending freely on recreational products such as home goods, patio furniture, RVs and boats.

However, many sectors of the US economy rebounded more quickly than expected while stimulus funds continued to flow. Meanwhile, the US labor force shrunk as workers chose to stay home or retire, leaving too few workers to meet strong demand. Similar dynamics across the world have led to supply chain shortages, further exacerbating the situation. This has all combined to create the inflationary spiral that we are experiencing today.

What happens to interest rates as inflation remains high?

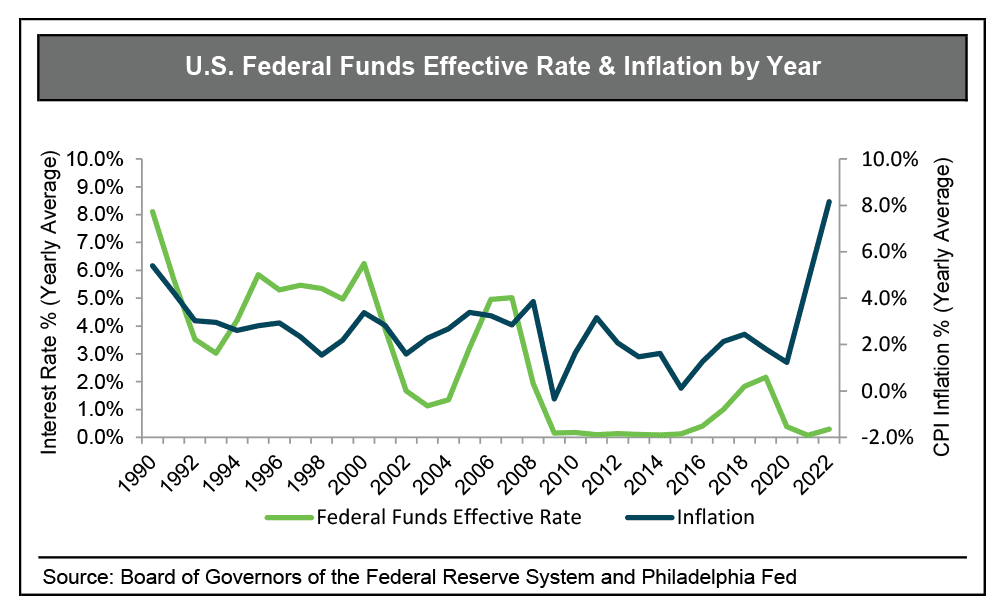

Inflation and interest rates tend to move in tandem as interest rates are the primary tool used by the Fed to counteract rising inflation. Due to historically low inflation rates over the past decade, the Fed had kept interest rates relatively stable.

The Fed maintained its policy of stable, low rates through 2021, even as initially inflation surged, based on an expectation that the spike in inflation was transitory. Fed Chairman Jerome Powell acknowledged that it had been late to act and pivoted to a policy focused on taming inflation with sharp interest rate hikes and other measures. Historical and current inflation and interest rates are presented in the chart below.

So how do inflation and interest rates impact valuation?

Inflation can impact business value in two main ways: 1) It can affect profits; and 2) It can affect how investors value those profits.

Inflation can affect profits by increasing a company’s costs. Businesses with pricing power to increase prices can maintain, and in some cases, increase profits in an inflationary environment. But, businesses that do not have the pricing power to increase prices will suffer lower profits.

Inflation affects the value that investors place on a company’s profits by amplifying risk and making a company’s cost of capital more expensive through higher interest rates that result from inflation. As interest rates and uncertainty increase, investors demand higher rates of return for the same level of cash flow, which all else held equal will drive down a business valuation. This can often be observed as lower multiples of earnings that investors pay for acquisitions. Rising interest rates can also affect multiples. Growth companies often feel the effects more than mature companies do as more of the profit is far in the future for growth companies. With higher required returns, investors heavily discount far-off future profits as compared with stable profits from a mature company.

The important thing to understand is that inflation and interest rates do not impact all businesses equally. There are businesses in certain markets or industries that are benefiting greatly from the increased demand. Companies with pricing power or low commodity inputs that can pass costs on will retain higher profits, offsetting some or all of the effect of lower valuation multiples.

How can business owners maximize value in this environment?

Take control of the value of your business by evaluating these areas:

- Risk reduction. Valuation multiples and rates of return are largely market driven. Business owners cannot control this. But, they can influence the valuation multiple of their business by reducing the risks impacting the business. Anything that management can do to secure the company’s profits will lower the risks of the business and help offset rising interest rates. This is because the higher level of certainty an investor can place on a company’s profits, the lower return an investor will demand.

- Focus on high-growth and high-margins. Rising costs will require higher productivity and efficiency to outpace increased cost structures. Intentional strategy and control over a company’s growth strategy and cost structure will also position it stronger coming out of this inflationary period.

- Focus on long-term measures. Slashing costs (i.e. personnel) at the sacrifice of growth will not increase the company’s value. Building business value is a long-term game. Accordingly, make long-term decisions, not short-term reactions.

- Invest in growth. Many companies are sitting on large amounts of cash. Consider putting this cash to work by investing in the growth of the company.

What does this mean for your business?

The impact of rising inflation and interest rates depends on the company’s position and goal.

As a business owner, if an ownership transition is not in your near-term plans, but you want to make sure you are taking the right measures to keep your business in a value-driven position, focus on the intangible investments you can make in your company to lower risk and protect, or even better, grow profits. If you are in this position, you have the luxury of time and can largely ignore the noise in the current market. A major influence business owners can have on lowering risk is to focus on continuing to build a business with a strong culture and organization to build a durable competitive advantage. In our experience working with hundreds of businesses in a wide range of industries, a strong, positive culture is one of the most durable competitive advantages a company can have.

If, instead, you are considering a near-term ownership transition, there are a couple considerations to be aware of. An owner looking to sell all or part of their business to an outside party may see the value of their business depressed due to the impacts of rising inflation and interest rates. A focus on growth strategy and cash flow creation will give you more control over value, specifically in industries that are favorable to growth through acquisition and while strategic buyers still have cash reserves to fund acquisitions.

However, depressed business valuations do not have to be a bad thing for all companies. As a business owner, if estate planning is a priority to you and you are considering an ownership transition through a gift or transfer of ownership to a family member, it may be an advantageous time to do so as market condition have naturally place downward pressure on valuations. Tax minimization is going to be a priority to you and a lower valuation may enhance your tax strategies.

Whichever your situation, proactive planning ahead of a transition ensures you can structure your exit and estate plans to achieve your goals in the most tax-advantaged way. We are happy to collaborate with you and your advisors to ensure your short to mid-term trajectory is focused on creating value in your business for whenever a transition is right for you.

To learn more about how the current climate is affecting estate planning, particularly in valuation discounts for lack of control and marketability for the purposes of estate and generational planning, read our ‘Estate Planning: The Bear Market Silver Lining’ article.

Contact us today

Contact one of our experts today to learn more.