The U.S. stock market has officially entered a bear market for the first time since the Covid-19 pandemic sent the stock market into a brief but deep dive back in March of 2020. Before this, you would have to look all the way back to the 2008 financial crisis to find the latest bear market. Bear markets are typically defined as a 20% drop in stock prices from the previous highs for a sustained period. Bear markets may or may not be coupled with an economic recession.

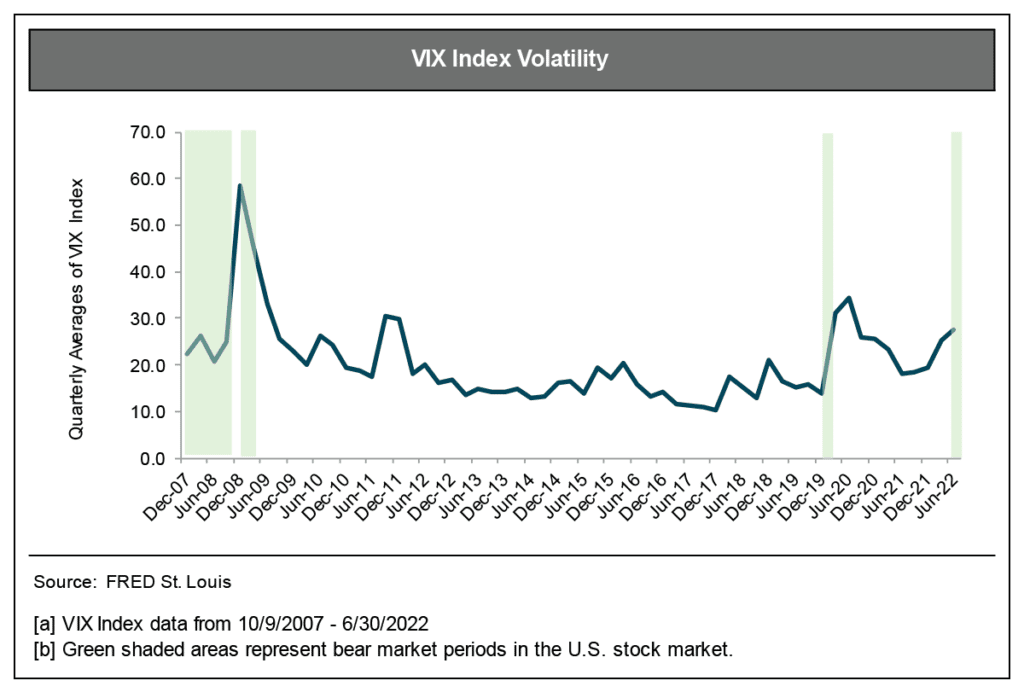

Why are we in a bear market? The stock market is mostly a reflection of investor sentiment and future expectations. To put it plainly, investors are worried and fearful of many things right now and the market is pricing in, or adjusting, to reflect those concerns and uncertainties. The stock market will continue to face headwinds as long as investors are worried about the economic outlook and future earnings prospects. News headlines and economic data surprises will generate volatility and wild swings along the way creating a tough environment for investors to find a stable return on their investments. The chart below illustrates the correlation between bear markets and elevated volatility.

Inflation & Interest Rates

Inflation is clearly leading the way for a sustained bear market. Inflation is at the highest in decades with the personal consumption index (PCE) coming in at 6.3% in April 2022 and the consumer price index (CPI) coming in at 8.6% in May 2022.

More importantly, inflation rates continue to exceed expectations quarter after quarter, forcing the Federal Reserve to raise its target federal funds rate by 0.25 percentage points in March, 0.50 percentage points in May 2022, and 0.75 percentage points in June and July 2022, which was the biggest increases since 1994. Many investors are expecting a similar raise in the federal funds target rate in September of 2022, all in an effort to combat inflation.

Essentially, the Federal Reserve is looking to decrease spending power and consumer demand by making it more expensive to borrow money. If demand goes down, then inflation should cool off, or so you would think. Supply, on the other hand, operates on its own agenda and the current supply chain is constrained to say the least. Low supply and high demand can lead to persistent inflation which is what we have been seeing and living for the last year or so.

This raises the next question: Can the Federal Reserve raise interest rates and tame inflation all while avoiding an economic recession? The answer to this question, which no one knows for certain, is driving market sentiment right now. To add to the confusion, throw in the Russia-Ukraine war, Covid 19 lockdowns in China and supply chain constraints and you can be certain that stock market volatility will remain persistent. Uncertainty breeds stock market volatility and the current economic environment is very unclear.

Estate Planning in a Bear Market

This is not all bad news. When one door closes another door opens. How can business owners take advantage of the bear market, stock market volatility and the uncertain economic environment? By planning! We will focus on a couple of specific planning areas where potential advantages can be realized.

Estate Tax

The estate tax is a tax on your right to transfer property at your death. In simple terms, it is calculated as the fair market value of everything you own, including your business, less eligible deductions, plus prior lifetime gifts, equals your taxable estate. For 2022, estates with combined gross assets and prior taxable gifts exceeding $12,060,000 are required to file and estate tax return.

Gift Tax

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. For 2022, the annual gift tax exclusion is $16,000 and the lifetime exclusion is $12,060,000 as noted above.

Now is a perfect opportunity to capitalize on estate and gift tax planning. High stock market volatility coupled with a rolling bear market will drive valuation discounts higher and overall business valuations lower. This allows more room for effective estate and gift tax planning strategies that can lower tax bills come 2023.

Valuation discounts for estate planning revolve around control and marketability. While both discounts are up in the current market, we’ll focus this discussion on marketability. Marketability is the ability of a commodity or asset to be sold or marketed. The time, cost, and effort to sell that commodity or asset plays a major role in determining the overall marketability.

Publicly traded stocks enjoy this feature, while a private stock does not. There is no active market for private stocks in which the security can be sold quickly, say three days. This fact alone results in a lack of or lessened amount of marketability when compared to publicly traded stocks which is why private stock trades at a discount to an otherwise identical public stock.

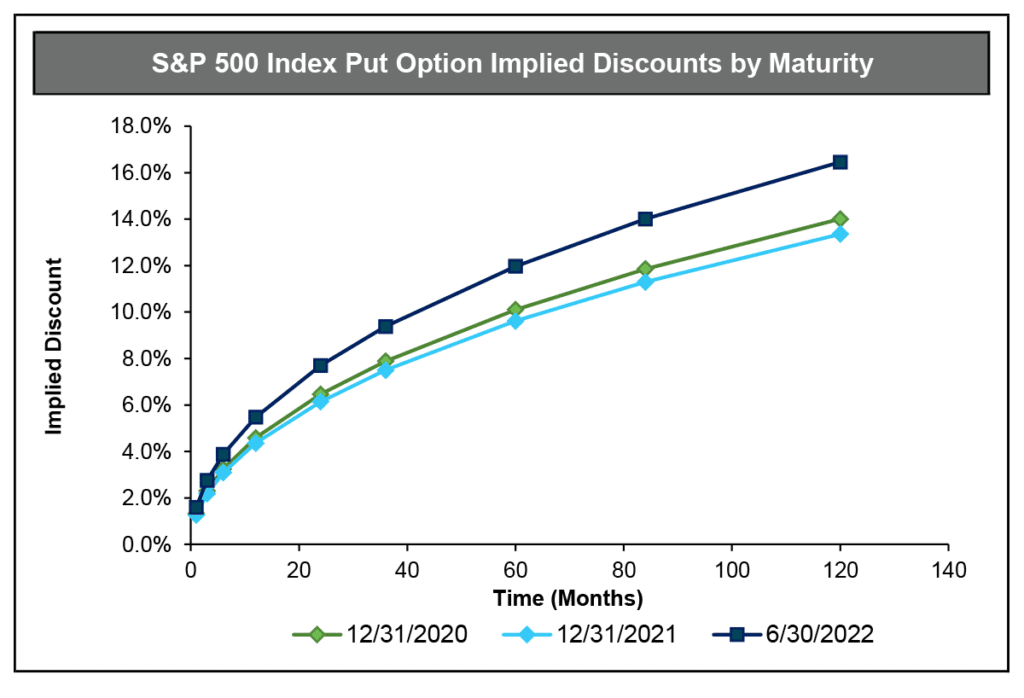

The value of marketability can be directly observed in the prices of at-the-money put options on public stocks. A put option gives the holder the right to sell at the strike price at any time up to the date of expiration. When the strike price of a put option equals the current trading price of the stock (i.e., “at-the-money”), the price of the option as a percentage of the underlying stock price gives us a good proxy for the value of marketability. The price of the put option can help us calculate what kind of discount the stock market would apply for a private stock that lacked such marketability.

Discounts for lack of marketability for private company stock tend to be higher than the discounts derived from put options because of longer and indefinite holding periods, restrictions on transfer, and company-specific reasons. Nonetheless, publicly traded put options can provide a starting point when considering the discount for a private stock.

As seen in the chart below, market volatility has a direct correlation to the calculated implied marketability discounts. As of June 30, 2022, stock market volatility, as measured by the Cboe Volatility Index (VIX), is higher than it has been over the past two years thus raising implied marketability discounts. The chart below summarizes marketability discounts implied by put options for the S&P 500 as of December 31, 2020, December 31, 2021, and June 30, 2022.1

Analyzing the current economic environment and its impact on the stock market is just the starting point to a great valuation. Discounts can vary company to company depending on risk and company-specific factors. This is why a robust analysis of the subject company is a core part of a defensible valuation.

1 Implied marketability discounts calculated using the Finnerty Model. Chart data provided by CBOE.

To learn more about how a valuation from Adamy can help you serve your clients with estate planning,contact one of our valuation experts.

Contact us today

Contact one of our experts today to learn more.